At the funeral for a friend’s father, I thought about the deceased. How he had affected my life. How, on my desk, still sits a folder with his name on it, and how I had successfully executed some of the things that he taught me, and that I should probably share some of those things.

Our First Meeting

Twenty years ago, I called and asked Mr. Henry Mariani to breakfast to talk about my business, FlagandBanner.com (FAB). It was in trouble, and I needed help, advice, or maybe just a sounding board.

What I learned is that there is no secret to business. The same accounting reports (P&L and Balance Sheet) are used by every kind of business and the ratios for measuring a company’s health are all the same, too.

So, years later, when it came time for FAB to consider buying another company, I called Mr. Mariani again, for his input.

Small Business Owners are Emotional

Like me, most small business owners are the founders of their company; stalwart protectors, and think of their businesses affectionately as one might think of a family member. In the past, I have jokingly referred to FAB as my first born.

This emotional connection to something you’ve birthed and grown over time tends to cloud one’s vision to the business’s worth. We all think our small business is worth more than it objectively is. I remember a banker once valued my company for a loan and I was insulted when he told me the price he came up with.

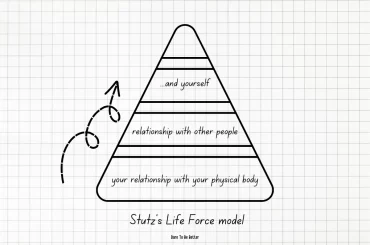

So, how do you value a business you are considering buying or selling? This is what Mr. Mariani taught me:

- The inventory, if being generous, is worth no more than 50% of its cost. If it is over a year old, it’s much less, if anything at all. Most companies have a lot of worthless stuff laying around that should, and needs to, be expensed off their books.

- The customer list is only good for 2 years of history; 3 years if, again, you’re being generous, because people move, change jobs, or get a new number. The value of such a list can range from $1-$5 a lead, depending on the company’s record keeping accuracy.

- Used equipment has no resale value, so only buy what you need. The rest is scrap or, dare I say, crap.

- Websites are the big new variable. Of all the companies I have bought, I have only kept one site live. Most small business owners don’t have the time or money to develop a good, working site.

- Buildings fall under real estate contracts. A separate valuation to consider.

- And last, Good Will, this along with a workable customer list are the most valuable asset. But, unlike the customer list, Good Will is intangible. The only way I learned to measure it is by asking myself, “What is it worth to me?” And then doing the due diligence of making a sales projection plan complete with the above-mentioned accounting reports.

Once again, I am reminded, as I often am on my radio show and podcast, that behind every successful businessperson lies the heart of a teacher. Thank you, Mr. Mariani. RIP